us exit tax calculation

It applies to individuals who meet certain thresholds for annual income net worth. When a person expatriates or gives up their US.

Renouncing U S Citizenship What Is The Process 1040 Abroad

The Exit Tax calculates the tax the and makes you pay that tax as the price of relinquishing US.

. In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or. The Expatriation Tax is a capital gains. Currently net capital gains can be taxed as high as.

Your average annual net income tax for the 5 years ending before the date of expatriation or termination of residency is more than a specified amount that is adjusted for inflation. The IRS considers the present net value. A person not excepted under either the dual-citizen or the age 18½ provision will thus need to take inventory of his or her assets in addition to assessing.

Calculating the exit tax is tricky in general but if youve got retirement accounts and foreign pensions it jumps to a whole new level of complexity. Citizenship they may owe Expatriation Tax. Note that you are required to pay the Exit Tax without having.

Exit tax is calculated using the form 8854. Exit tax is the IRSs last chance to tax you and is essentially taxed as if you were to sell all your assets on the last day of living in the US. The US exit tax applies to several different types of assets that may be owned by an expatriate and is calculated differently for each type.

In fact it does not even require that the green. The exit tax calculation. The second way to become a covered expatriate is to have a high-enough average net income tax liability for the five tax years before the year of expatriation.

In order to calculate the amount of exit. The Exit Tax itself is computed as if you sold all of your worldwide assets on the day before you expatriated. Certain individuals who give up their US citizenship or their green cards are subject to the so-called exit tax imposed under Section 877A of the Internal Revenue Code Code.

Citizenship or long-term residency triggers both the exit tax and the. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. If a Green Card Holder has been a permanent resident for at least 8 of the past 15 years they become subject to expatriation tax laws as well.

Citizens and long-term residents must carefully plan for any proposed expatriation from the US.

California Taxpayers Can Check Out Any Time They Like But Lawmakers Still Want To Tax Those Who Leave

What Are The Us Exit Tax Requirements New 2022

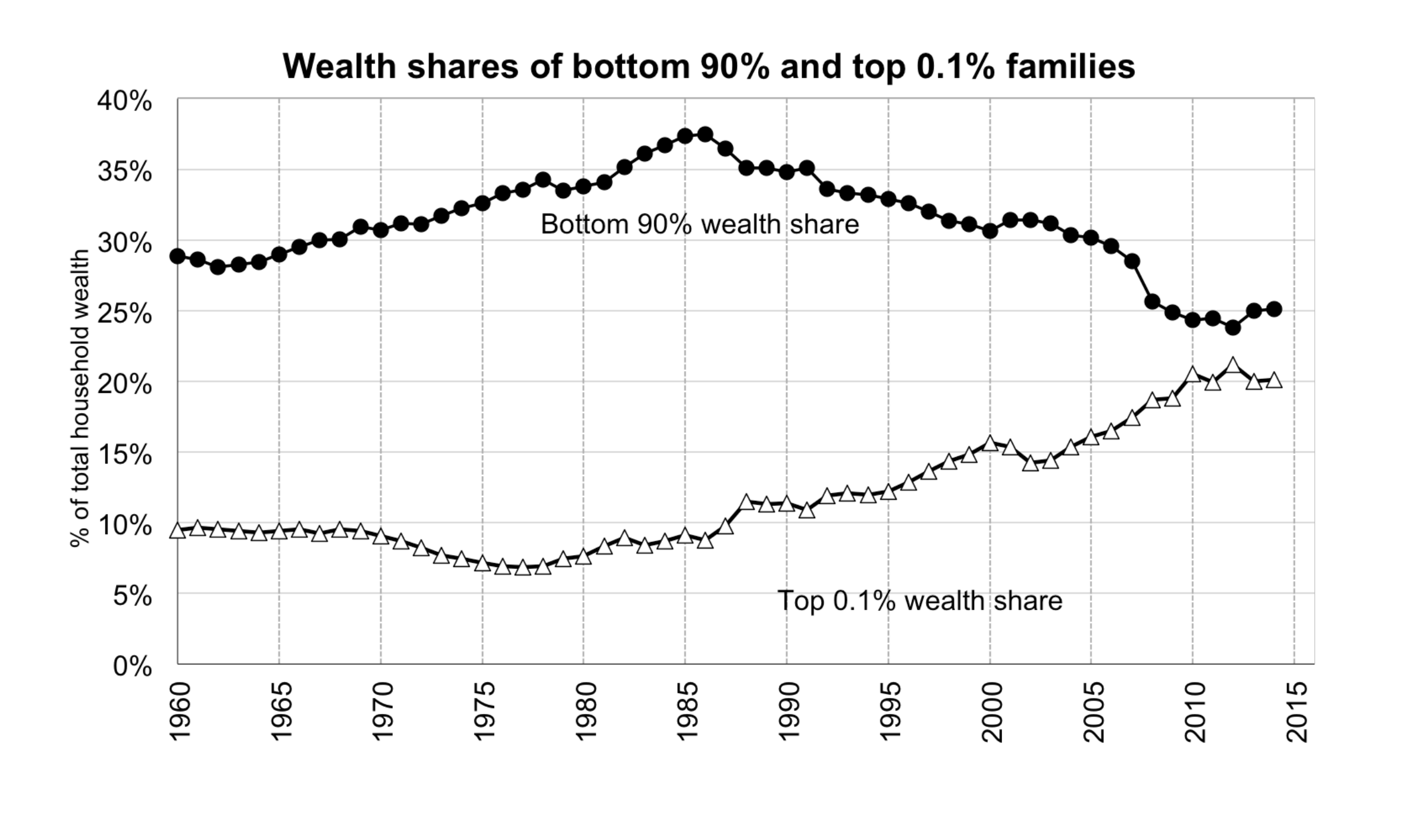

Ultra Millionaire Tax Elizabeth Warren

Renouncing Us Citizenship Expat Tax Professionals

The Taxes That Raise Your International Airfare Valuepenguin

Can I Receive A Refund From The Irs For Overpaid Taxes San Jose Ca Tax Lawyer

Income Taxes And Immigration Consequences Citizenpath

Irs Exit Tax For American Expats Expat Tax Online

How To Escape The Exit Tax Escape Artist

Never Give Up Or You Ll Be Surprised

Departure Taxes And Fees Golden Eagles

Us Exit Tax Giving Up Us Citizenship Or Green Card The Wolf Group

Federal Income Tax Filing Nonresident Office Of International Students Scholars

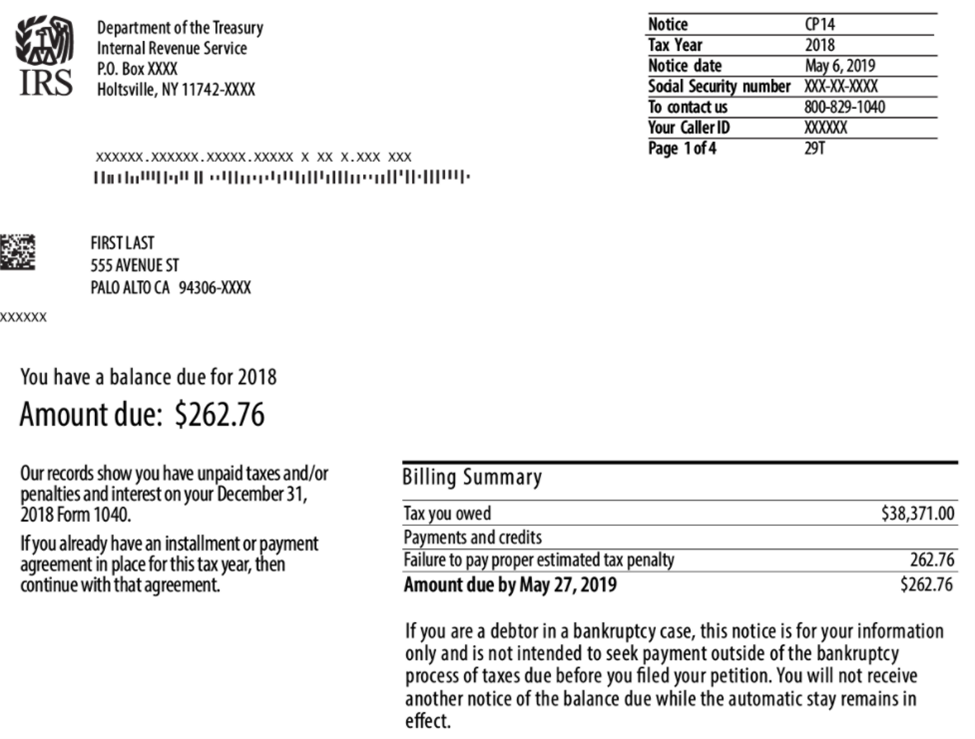

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

Tricky Israel Us Tax Rulings Opinion The Jerusalem Post

Renounce U S Here S How Irs Computes Exit Tax

The Taxes That Raise Your International Airfare Valuepenguin